Let me tell you as an 80s kid who grew in India, how naïve I was till I got exposure to internet and started reading! Well probably, that was just me who was a slow learner in understanding how to make it BIG in life. I was 30 already by the time I started figuring out things and spent another 12 years still mastering the craft. But as I console myself: Better late than never!

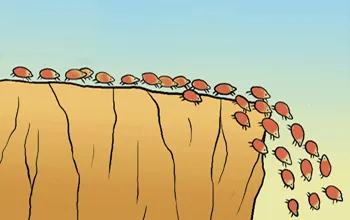

So what did I do wrong in first 30 years? Answer is today`s topic “I just followed the crowd blindly” all the way along. And the minute I started studying biggest wealth creators, entrepreneurs and innovators, there was a common denominator I found “They are all independent thinkers and totally disconnected from the crowd behavior”. If you study any of the Forbes billionaires or artists, they usually follow the path least travelled and stand out in their execution.

If it was this simple, then why cant everyone do it and get into the top 1% ? Well the answer is “Its simple but not easy. Because human beings are wired to think and act according to the societal norms. We are social animals and our herd mentality goes a long way right from days of evolution (fight or flight). Its really scary for human beings to go against the crowd, instead we beings always look for social acceptances. Legendary Charlie Munger calls this crowd mindset as “Lemmings-like”

This is deep rooted and affects every aspect of human life right from the education we choose, jobs we accept, marriage, economic status we build for social acceptance, place we choose to settle, materialistic behavior and so on. There are only very few people who go against the crowd and go behind the opportunities even when nobody believes in them. That 1% white-space is scary, isolating, confronting, risky, uncomfortable and what not.

Now how to make it Big in 3 steps? Here is the secret sauce:

- Big opportunities lies in white-spaces where the crowd doesn’t go or are scared to go due to risks or complex paths. They are usually least travelled paths avoided by the herd

- Go All In: Take big bets or large stake in terms of capital or energy or effort when you find such opportunity

- Find a great team and mentors to execute the venture

Let me end with few of Stoic preaching from Seneca`s “On the shortness of life” which might help pursue true purposes,

- Humans are constantly preoccupied with something (greed, labor, fear)

- All abundances and possessions comes with more burdens

- Slow down from the hustle to find true selves

- “It is not that we have a short time to live, but that we waste a lot of it. Life is long enough, and a sufficiently generous amount has been given to us for the highest achievements if it were all well invested.”